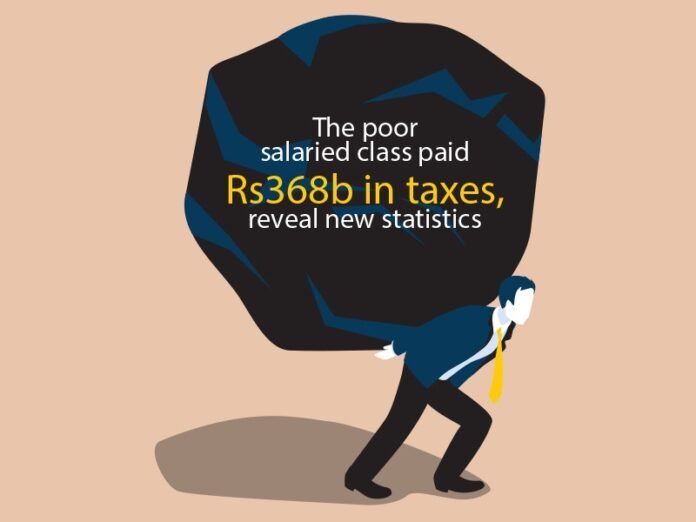

A significant development has emerged as the salaried people of Pakistan are now the third largest contributors to the tax revenue of the country, reflecting the growing dependence on this sector to strengthen public finances. According to the FBR, there was a 39.3% year-on-year growth in tax collection from salaried individuals during the fiscal year 2023-24, which reached Rs368 billion, up by Rs103.74 billion compared to the previous year.

Drivers of Revenue Growth

The tax receipts from the salaried class witnessed a boom. This boom was part of a larger one that cut across many sectors. The largest sectoral revenue contribution came from contracts, which recorded Rs496 billion, up from over Rs106 billion. Next came taxes on bank interest and securities at Rs489 billion, showing a very healthy increase of 52.8%. Revenue from dividend payments also recorded a healthy jump of 70% to reach Rs145 billion.

Property transactions were the other significant source, which accounted for Rs104 billion in purchases and Rs95 billion in sales. Even routine expenses faced a tax increase as electricity bills contributed Rs124 billion, up by 30%, and telephone bills generated nearly Rs100 billion, which reflected a 14.3% increase.

Expanding the Tax Base

The increase in tax revenue indicates a broader tax net and better compliance from the salaried class, a section of society which has always been easier to tax due to fixed incomes and transparent payroll systems. At the same time, it underlines the pressure on the salaried individual due to increasing inflation and not-so-good wage growth.

The export sector, too, contributed Rs94 billion, growing by 27.2%, while taxes from retail transactions, technical fees, commissions, and cash withdrawals added to the overall revenue. These figures underline the FBR’s efforts to diversify revenue streams and tap into previously underutilised sectors.

Challenges and Implications

While the increasing salaried population increases government revenues, it does raise questions regarding the fair sharing of the tax burden. Further straining household budgets are indirect taxes on electricity and telephone bills, making the need for a more progressive tax system pressing.

Read More: Almost Half Of Taxpayers Don’t See their Taxes Being Spent for the Public Good

This data underlines the salaried class’s role in sustaining Pakistan’s economy but also reminds the financial pressures they face. Moving forward, tax fairness and reducing reliance on a few income groups will be the keys to fostering a more inclusive and sustainable fiscal framework.

Stay tuned to Brandsynario for latest news and updates