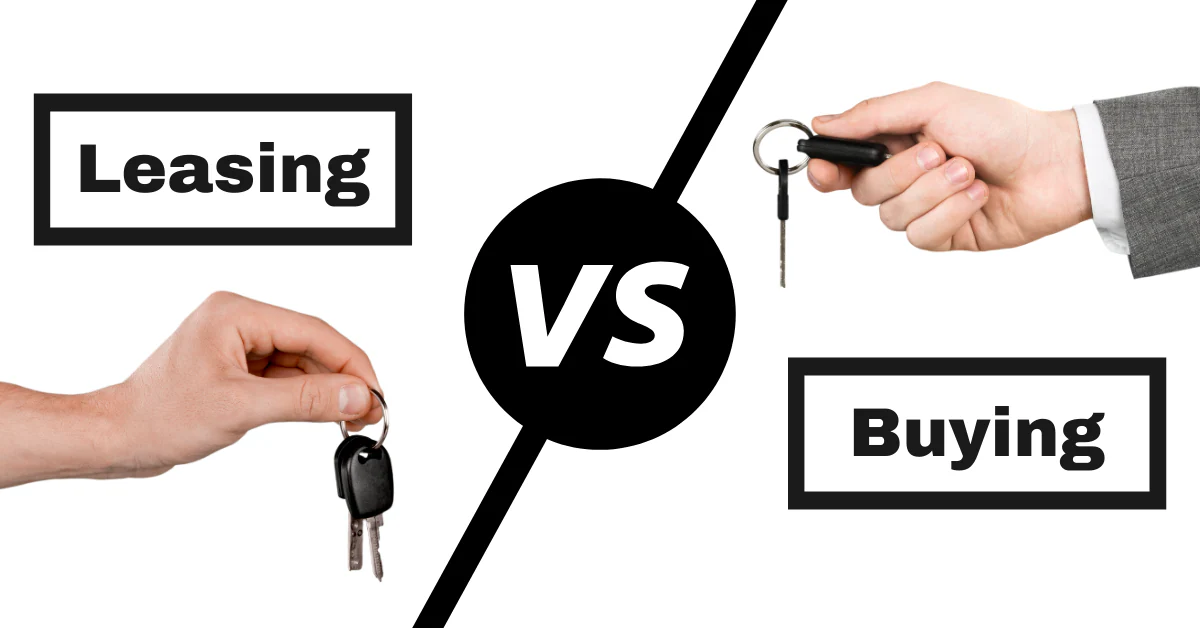

Your automobile is more than simply a means of transportation in Pakistan’s busy streets; it’s a declaration of your freedom and mobility. If Hamlet was in Pakistan, he would be plagued with the same question that all Pakistani drivers think about, To Lease or Not to Lease! Its a big decision in anyone’s life, specially in this fast changing automobile industry wether they should buy or lease their next vehicle?

The Current State Of Automobiles

The Pakistani car industry has experienced a significant turning point in 2024. The scene is changing with the release of new competitors and models like the Haval Jolion Hybrid and the Toyota Corolla Cross. Consumers have highly anticipated these debuts, indicating a rising desire for cutting-edge and environmentally responsible automobiles.

The vehicle market in Pakistan is expected to generate a whopping 100+ Crore PKR in revenue by the year 2024, with a compound annual growth rate (CAGR) of 0.13% from 2024 to 2028. Despite economic constraints, growing urbanization and a growing middle class are the main drivers of this expansion.

The Everyday Challenges For A Pakistani

High government taxes, a lack of competition, and unstable economic conditions worsen the challenge. The procedure entails managing intricate paperwork and overcoming the “Own Money” problem, which charges more for quick purchases.

Inefficiencies in Pakistan’s public transport system makes the situation even worse for the “Aam Aadmi“. Not only have they proven to be ineffective, but cause traffic jams, pollution, and have shown lack of safety on multiple occasions. The overall expense and hassle for those who commute on a regular basis make automobile ownership or leasing a more practical long-term option.

What Does Leasing A Car Even Mean?

Similar to a long-term rental, automobile leasing provides the opportunity to drive a new car for a predetermined amount of time without having to commit to the whole cost of purchase. For people who want flexibility and cheaper upfront expenditures, it’s a compelling alternative.

Leasing may reduce credit line usage, avoid the high initial cost of car ownership, and ease the maintenance strain. For people who would rather swap automobiles regularly but don’t want to deal with the headache of reselling, it’s a sensible option.

What’s The Process Of A Car Lease?

Usually, leasing an automobile entails choosing a car, submitting a bank loan application, making a down payment, and then making monthly installment payments. Leasing alternatives from several banks are competitive, and the process is quite simple. Here are a couple of things you’ll need to know:

- As a national, you must earn a minimum wage salary and be aged between 20-60.

- You must have a track record of being a loyal employee by showcasing you are working a permanent job through which you can cover the costs.

- The time period of your loan can vary depending on your feasibility to pay it back and you must be willing to pay a certain interest rate in some cases.

- You will need to make a down payment at the initial stage, which will be around 20% of the vehicle’s total value.

Should You Buy Or Lease Your Next Vehicle?

In Pakistan, the choice to purchase or lease an automobile depends on a person’s specific situation. Purchasing a car is a long-term commitment that might result in ownership equity, but leasing provides instant access to a vehicle with less financial burden. Its completely up to you at the end of the day.

Weighing the benefits and drawbacks of owning vs leasing is essential as Pakistani drivers traverse the decision-making process. Making the appropriate decision can make the next trip as enjoyable as the voyage itself.

Stay tuned for more automotive tips like these; this is your soon-to-be favorite friendly neighborhood gearhead Zayaan, Signing Off!