From time to time you must have heard someone say, “But oh, we do not even make enough to pay taxes, then why should we file a return?” It is not about whether we qualify to pay taxes or not, if we live in a country, we need to accommodate the government by providing them the trail of our income and expenses so that they are better capable of assisting us. Here is where our responsibility comes in. We need to assist by filing our tax returns regularly.

To pay or not to pay?

It is only after we do our work and the government does not take better care of us that we can start blaming them. Once we file our tax returns and then we find the broken roads, the increase in robberies, and the withering city, we are in a position to complain. But if we are not doing our end of the work, do we qualify to whine?

Read More: Robbery On The Rise – 5 Routes In Karachi You Should Avoid

In that regard, let’s look at the process of filing for taxes because the Federal Board of Revenue (FBR) does actively tries to make it easier. Recently, they have made the entire process online; one that you can do yourself and for free.

How to file tax returns?

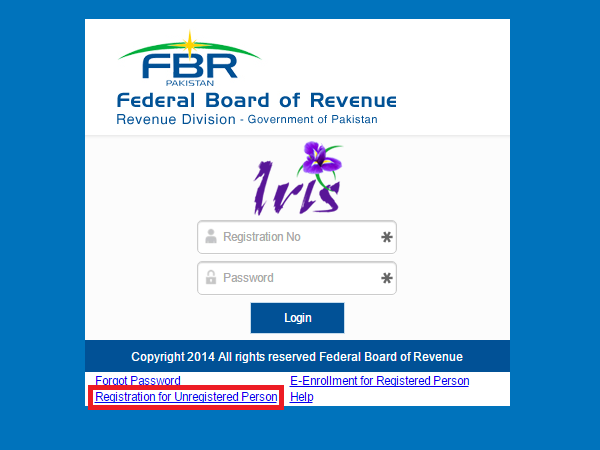

The process starts with directing to the FBR website. Amongst multiple options, choose the portal, IRIS. Next up, you have to choose your location; within Pakistan or outside. Register on the portal, first. To log in, you will use your CNIC as user ID and password that was emailed to you by FBR.

Declaration

Go to Declaration, choose the salaried return option. It will open a window where you type the year the return is for and choose the provided option.

Enter your annual salary details. Hit calculate.

Enter other revenues like bank profit.

Do enter any taxes that your company deducts from your salary in the Adjustable Taxes tab. Hit calculate!

Wealth statement

You mention the personal expenses that include rent and utilities.

Add personal assets like property and their values.

You will have to justify the difference between revenue and expenses.

How to file tax returns for freelancers

In the tab of Declaration, select ‘normal return’.

The method is the same from choosing the tax year to adding your salary.

For freelancers, choose the ‘business’ tab. Wholesalers and Retailers can choose the manufacturing and trading section. For other category freelancers, they can choose ‘other revenue’ section to add their revenue detail.

Next, go to the ‘management administrative expenses’ tab. There, you can add rent and salaries, and other expenses.

The tax now calculated will show the difference as taxable income.

Do not forget to reconcile the amount with the wealth statement.

Read More: FBR Announces Punishments For Filers Missing Deadline

This concludes your work as a dutiful citizen.

Stay tuned to Brandsynario for the latest news and updates!