Launching a business can be fun until it has to be provided with funding too. It is one of the biggest reasons behind business ventures failing. Whether someone is starting from scratch or looking to scale, they must first see how they can secure the right financing all while keeping the costs as low as possible. This can be pretty basic yet very complex, especially when you don’t know how to fund your business with the right resources.

Capital: The Importance of Business Financing

Every business needs capital — for product development, marketing, staffing, and day-to-day operations. Consider it the “lifeblood” of a business venture. Without proper funding, even the best business ideas can struggle to take off.

If a business has enough capital, it will be able to cover it’s initial cost much better and run day to day expenses more smoothly. Especially, in a crisis.

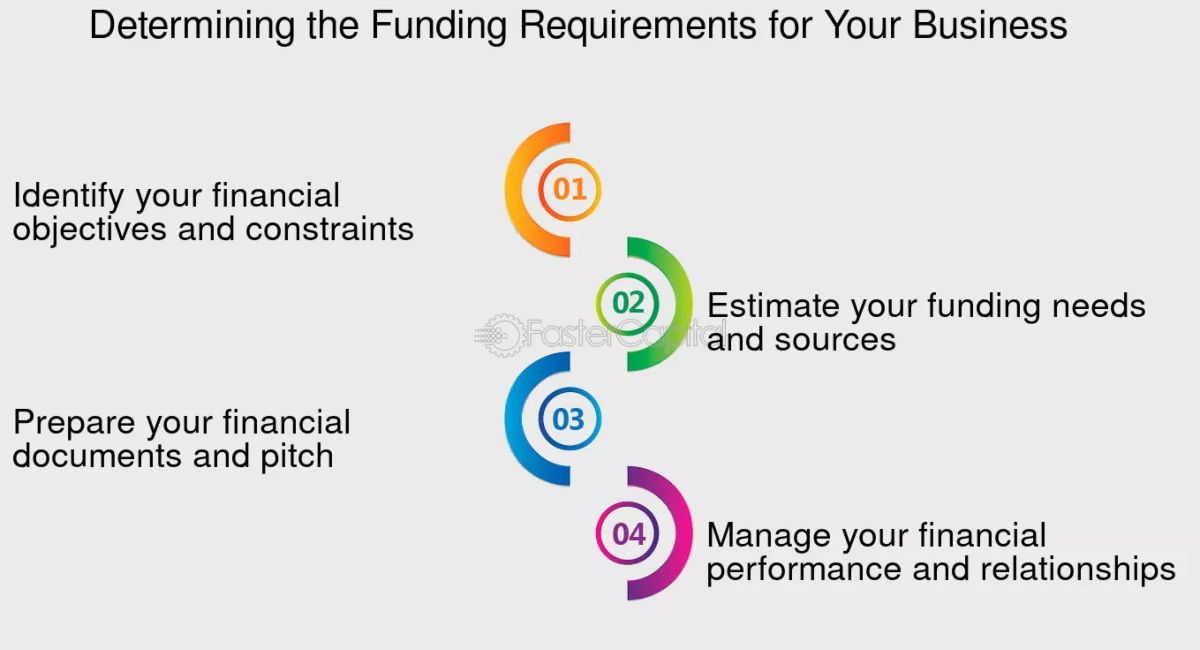

Determining How Much Capital Is Required: Costs and Expenses

Before you start pulling your hair out over how to fund your business, it is important to understand how much capital you need to start with. As dreading it is to do calculations, it must be done. First make an estimate for the initial costs and regular expenses i.e:

- Licenses and permits

- Trademarks, copyrights, or patents for your brand and products

- Business insurance

- Legal or accounting assistance

- Rent and utilities (for brick-and-mortar businesses)

- Equipment required for production

- Website platforms

- Marketing materials (both print and digital)

- Shipping supplies

- Subscriptions to content management systems and sales or marketing platforms

- Market research

When this list is complete and the brain storming is done, you will have a proper estimate. Before raising capital, it’s also wise to familiarise yourself with how to read and create a balance sheet, income statement, and statement of cash flows. Financial literacy is a critical skill for entrepreneurs, and being aware of these financial statements will ensure you’re taking the necessary steps to become a responsible business owner.

Read More: How to Start a Print on Demand Business in Pakistan

How to Fund Your Business? Ways to Finance

Every business has different needs, and no financial solution is one-size-fits-all. Yet, here are some common ways people use to fund their business.

1. Bootstrapping: Starting with Your Own Money

Bootstrapping is the most organic way to fund your business — using your personal savings or revenue generated from the business itself. If your projected expenses add up to a manageable amount, you may be able to fund the business yourself. This can involve taking money from your personal savings account, dipping into your retirement funds, using credit cards and paying back the debt, or asking for donations from friends and family.

This allows you to retain 100% ownership and control. There are no underlying debts and no one is there sitting on your head waiting for a payment. This is a big relief and allows room for much more efficient business operations. However, it must be kept in mind that through this the business growth may be slow due to limited funds and there is always a risk of depleting personal savings or assets.

Pro Tip: If you choose bootstrapping, track your personal and business expenses separately to maintain financial clarity.

2. Getting Capital From Friends & Family

Borrowing money from people you trust is a common first step for many entrepreneurs, especially when bootstrapping falls short. This is a much easier way to secure funds in comparison to traditional loans. There are no hectic formalities involved and the repayment terms are quite flexible too; especially with no interest.

But keep in mind that in worst case scenario, your personal relationships can become strained if the business fails or repayment is delayed. You are warned, be careful with this none.

Pro Tip: In order to succeed in this, you can create a written agreement that outlines the repayment terms. Also, make sure you communicate everything regarding business progress.

3. Bank Loans and Business Lines of Credit

Traditional business loans and lines of credit are reliable sources of funding, especially for businesses with a track record. However, before applying to banks and credit unions you must prepare a business plan. This should involve the value proposition, expense report and financial projections for the next five years. Most banks or credit unions will surely ask to see some combination of these documents when considering your application.

Types of Loans:

- Term Loans: Fixed amount repaid over a set period.

- Lines of Credit: Flexible borrowing as needed, similar to a credit card.

- SBA Loans: Government-backed loans with favorable terms for small businesses.

A plus point for these loans can be that they have a predictable repayment structure- quite straight forward. And it also give the opportunity to build business credit. However, it isn’t given to just anyone as it requires a strong credit score, collateral, and a solid business plan. Moreover, it’s approval can take weeks or months.

Pro Tip: Only get involved in this if you are a established businesses or startup with assets and revenue history.

4. Venture Capital: Scaling Big and Fast

Venture capital (VC) is a type of private equity where firms invest in high-potential startups in exchange for significant equity. This will allow for large amounts of funding to be available and an access to a network of experts, advisors, and potential customers.

However, a fallout will be that there will surely be a loss of significant ownership and control. The business owner will come under a lot of pressure as the VC firms often expect rapid growth and large returns, increasing the pressure.

Pro Tip: To attract VC funding, have a disruptive idea, scalable model, and a strong founding team.

The Best Way to Finance Your Business

Keep in mind that no two businesses are the same and hence the solutions for funding aren’t the same either. Only you know the ins and outs of your company’s needs. By weighing the risks and rewards of each funding option, along with your personal finances, predicted startup costs, and business expenses, you can select the best option for financing your business.

Stay tuned to Brandsynario for the latest news and updates.