The Sindh Revenue Board (SRB) has authorized 58 restaurants and hotels in Karachi to collect a 15% service tax on digital payments, up from the previous 8%, thus denying taxpayers a facility originally introduced to promote economic documentation.

Initially, the Sindh budget for the fiscal year 2024-25 (FY25) reduced the Sindh Sales Tax (SST) on restaurant services paid via debit and credit cards from 15% to 8%. However, the SRB’s recent notification allows only a select few establishments to collect the higher 15% tax to enable input adjustment of tax payments.

Only restaurants with an integrated Point of Sale (POS) system are eligible to collect the 15% tax. While there are hundreds of thousands of restaurants in the province, only 1,700—mainly in Karachi—are registered with the SRB. Among these, few are high-end eateries. Tax experts suggest that only these larger establishments with significant market share have been granted permission to collect the higher service tax.

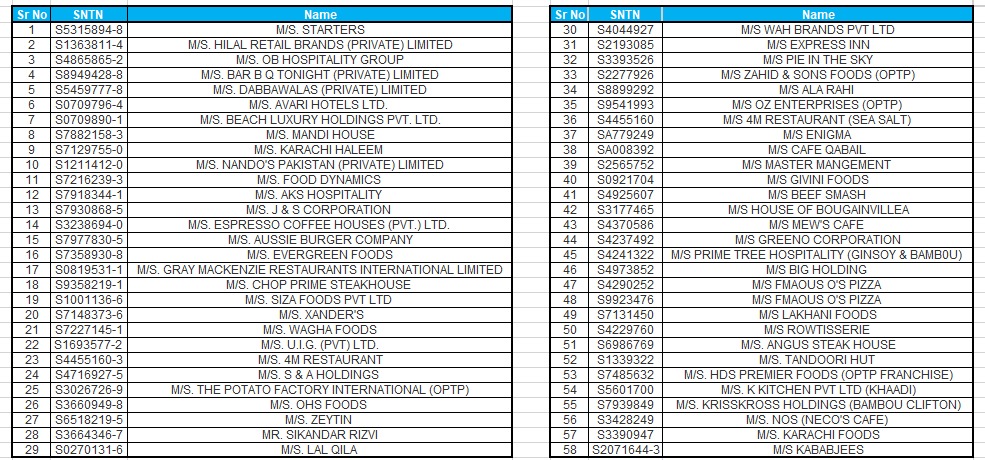

The SRB stated in its notification that out of the more than 1,700 registered restaurants, only 58 had obtained the necessary permission to charge the 15% SST. These restaurants must have POS invoicing systems integrated with the SRB system and comply with the Sindh Sales Tax on Services Act, 2011.

List of restaurants:

This development is part of the SRB’s new working tariff for the tax year 2024-25, incorporating amendments from the provincial budget 2024. According to the notification, the new tax rates apply to all restaurant services, including those at hotels, motels, guest houses, and farmhouses.

Contrary to reports suggesting the SRB has revoked the lower service tax rate for all Karachi restaurants, the board clarified that this facility remains operative. The SRB emphasized that restaurants wishing to apply the standard 15% SST rate on digital payments must obtain permission per rule 42(1)(b) of the Sindh Sales Tax on Services Rules, 2011.

The SRB also advised customers to verify the applicable SST rate before dining out by visiting the SRB website or requesting written permission from the restaurant.

Stay tuned to Brandsynario for the latest news and updates.