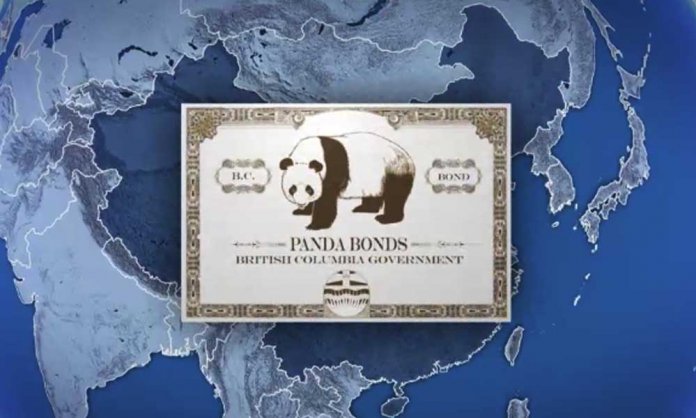

For the first time in history, the federal cabinet has approved a new financial strategy called Panda-Bonds in Pakistan. These bonds will become the new and favorable method to raise foreign exchange.

In a meeting on Thursday headed by Prime Minister Imran Khan, the strategy received approval. On the occasion, spokesperson to Finance Ministry Dr. Khaqan Najeeb shared that the Panda Bonds have been finalized after many meetings, consultations with Chinese Banks and several regulatory authorities in China and even stock exchange.

He said:

They will help government diversify investor base of capital market issuance and provide a source of raising renminbi (RMB)

What are Panda Bonds?

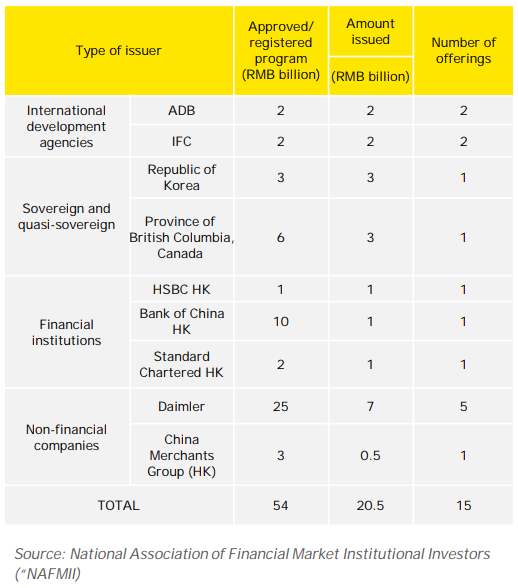

A Panda bond is a Chinese renminbi-denominated bond from a non-Chinese issuer, sold in the People’s Republic of China. These bonds were first issued in 2005 by the International Finance Corporation and the Asian Development Bank.

The Chinese government had been negotiating for several years about implementation details before permitting the sale of such bonds; they had been concerned about the possible effects on their currency peg.

How Will Panda Bonds Benefit Pakistan?

According to the spokesperson, the bonds will help Pakistan’s government to diversify the current investor base in capital market insurance and will also be used as a source of raising Renminbi.

Furthermore, he added that the tenor, size and pricing will be determined according to the market response at the time of issuance. The spokesperson also mentioned that the issuance will be done in several rounds.

As of now, expectations are high and a good response is currently being shown by investment groups and Chinese Banks.

The Idea of Panda Bonds in Pakistan

The idea of introducing the Panda Bonds in Pakistan was going on for some time now. The idea initially was going around during PML-N’s time.

However, the decision was delayed due to the Debt Office in the Ministry of Finance had cautioned the government to review the fluctuation of Chinese currency versus US Dollar before moving forward.

According to official sources:

The timing of launching the bond has importance and now the government has decided to explore this option in the second half of the current fiscal year

The Chinese Renminbi-denominated Panda Bond will be accomplished in two tranches in Shanghai (China) and expected to fetch half a billion dollars.

Issuance of Panda Bonds

The RMB-based Panda Bond will fetch equivalent to $200 million and in the second tranche, it can go up equivalent to $300 million within the ongoing fiscal year.

Are you excited for this new venture?

Stay tuned to Brandsyanrio for more news and updates.