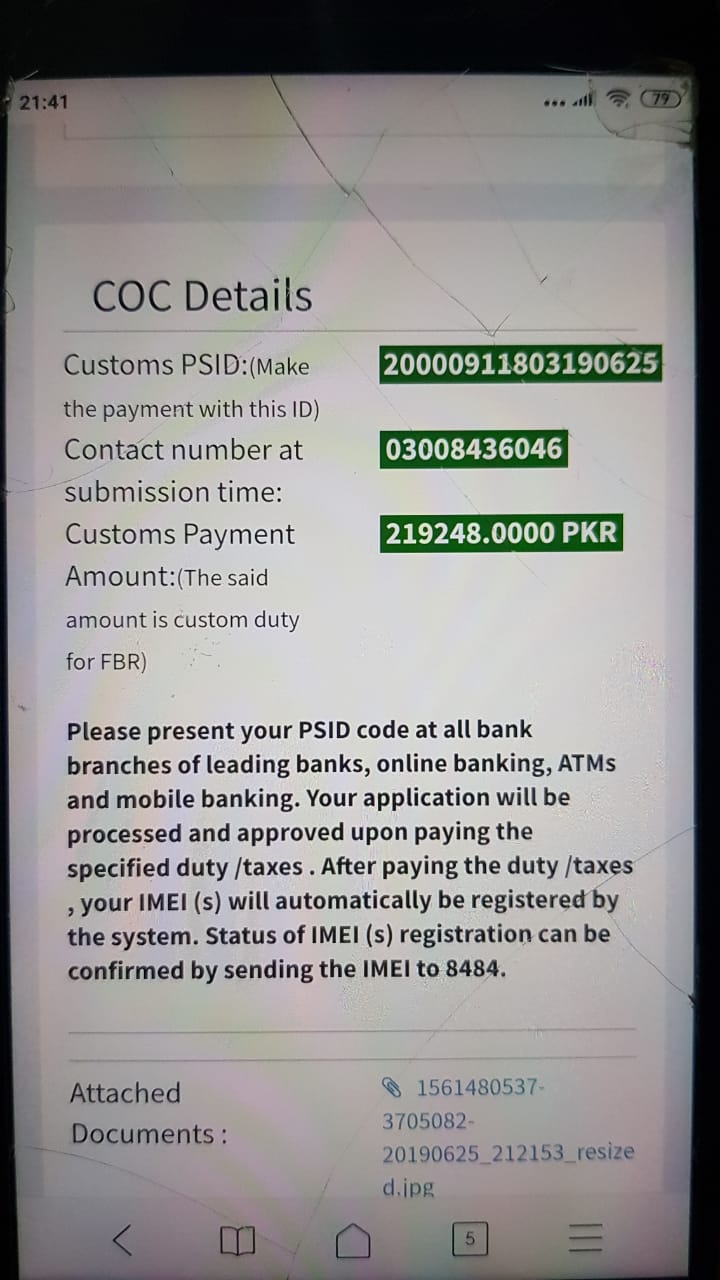

The taxes the PTA (Pakistan Telecommunication Authority) places on smartphones has surged to the forefront of Pakistani debate, particularly relating to phones not bearing PTA approval. Users who buy high-end cell phones from overseas frequently voice their annoyance. This is an explanation of the controversy surrounding the PTA tax.

Pakistan-Only Tax

Although every country imposes different taxes and duties on imports, this unique PTA tax applies only in Pakistan, stoking further frustration. In many parts of the globe, carrier or factory-locked phones come with standard taxes and work internationally once unlocked. But in Pakistan, even a legally purchased and unlocked phone requires more taxes for it to get PTA approval. Users consider this an unnecessary burden.

Concerns Over Mobile Theft and Security

The lack of strong security measures against theft in Pakistan compounds the issue. There’s a growing trend in mobile thefts leaving users wary of investing big in PTA-approved devices. They argue that paying high taxes on a phone, only to have it stolen with minimal chance of getting it back, feels like being punished twice over. This has made some prefer non-PTA phones that, even if stolen, don’t add another financial setback.

Reluctance to Change Devices

One of the reasons people stick to non-PTA phones is their faithfulness to certain brands or operating systems, like Apple’s iOS or Google Pixel. Lifelong users find it impractical to shift to locally made, PTA-approved gadgets due to the ingrained habits they’ve formed. The tax scenario compels them to choose between paying high taxes or resorting to other options such as SIMs from different regions.

To put it simply, PTA’s smartphone tax stirs debate due to its steep price, scant benefits, and the distinct issues related to life in Pakistan. Several advocate for fairer tax policies that align with the nation’s economic conditions rather than driving people towards non-PTA options.

Stay tuned to Brandsynario for latest news and updates.